A

variety of not-for-profit organizations receive inadequate attention

from the financial services industry. These organizations often operate

without professional guidance in growing capital to build new, or

rehabilitate existing buildings, and to purchase mission critical

equipment. Reaching these goals requires an informed assessment of the

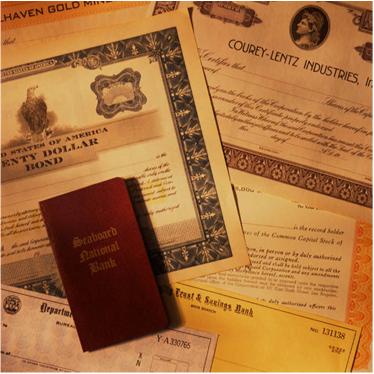

potential advantages of tax-exempt and taxable bond financing.

Our expertise can be invaluable. It includes credit and debt capacity analysis as well as detailed knowledge of financial products such as bonds, interest rate swaps and other derivatives. We also advise our clients in determining the appropriate fees to pay for the financial product and, most important, the appropriate interest rate for the financial product given current market conditions Our advice is free of any conflicts of interest in that we have no vested interest in selling or promoting any particular financial product.

DEBT FINANCING SERVICES

DEBT FINANCING SERVICES

ANALYTICAL & PLANNING SUPPORT